“And it was just right.” Goldilocks

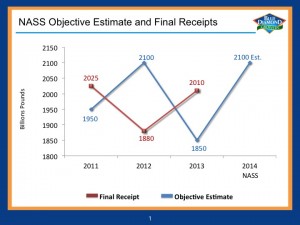

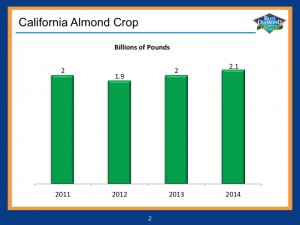

On June 30, NASS released their Objective Estimate of 2.1 billion pounds. It would make the coming crop a new record, although only 5% higher than current crop. The industry was surprised. Forecasts were generally lower due to drought impact and extrapolating some challenging local conditions. I see this higher number as a welcome surprise. The 2.1 billion supply is good for industry and truly a goldilocks forecast.

Demand for the 2013 almond crop is on pace to grow by 5% with supply of just over 2 billion pounds. The industry is once again selling the entire crop with minimal carryout inventories. Already supplies are getting low with limited quantities of particular varieties and sizes. As a result, summer pricing is matching pre-bloom peak pricing. Even though the industry has sold a small portion of the 2014 crop at a discount to current crop pricing, the pricing levels have still been at a premium to the 2013 average. There is low urgency to move the crop. For the last three years, almond handlers have watched prices increase with harvest and build through the season.

Demand for the 2013 almond crop is on pace to grow by 5% with supply of just over 2 billion pounds. The industry is once again selling the entire crop with minimal carryout inventories. Already supplies are getting low with limited quantities of particular varieties and sizes. As a result, summer pricing is matching pre-bloom peak pricing. Even though the industry has sold a small portion of the 2014 crop at a discount to current crop pricing, the pricing levels have still been at a premium to the 2013 average. There is low urgency to move the crop. For the last three years, almond handlers have watched prices increase with harvest and build through the season.

For the 2014 crop, it would be appropriately conservative to forecast a 5% growth in demand. This would assume developed markets like the US, UK and Japan continue to grow; while China and India remain static. Applying 5% growth in demand to current supply conditions would indicate that we need a 2.1 billion crop in 2014. The math works perfectly. Until we get significant news to the contrary, the outlook for almond prices remains stable to bullish.

It appears the 2014 crop will arrive earlier than any crop in recent history. Even with this early start, it will be late October before anyone understands the actual size of this crop. Until then, history, capacity and cash flow will drive the industry to commit over 50% of the harvest using the best available information, NASS.

As a reminder, the historical reliability of the NASS forecast has been good, still the range of error for the last two years has been +- 10%. With almond inventory levels so low, the impact to the industry from this range of numbers is substantial. With a hot summer forecast and continuing drought, a larger crop seems unlikely, although it would bring inventory availability and price stability, allowing markets in Asia to return to double digit growth. This could be good for industry, consumers and growers. A smaller crop seems more likely and it could create supply shortages and further upward spikes in almond prices. With any drop in the almond crop, the industry would be forced to raise prices to ration supply.

It is far healthier for Blue Diamond and the industry to have large and growing crops. Product innovation, great advertising and market development will continue to create demand and that in turn will drive pricing. This is how we have increased industry profitability the past several years without losing our customers. This is sustainable, long term profitability for the industry, not a short term market cycle. For these reasons, 2.1 billion pounds in 2014 is my “just right” crop..