“Innovation in anything, but business as usual.” – Anonymous

For Blue Diamond, business as usual is dramatically changing. We are dedicated to value-added almond product development, business expansions to meet demand and leading grower returns. With several years of success, we are establishing ourselves as the almond handler of choice. Our growers have always valued the power of the Blue Diamond brand and they are just beginning to realize the full potential of our co-op brand.

For Blue Diamond, business as usual is dramatically changing. We are dedicated to value-added almond product development, business expansions to meet demand and leading grower returns. With several years of success, we are establishing ourselves as the almond handler of choice. Our growers have always valued the power of the Blue Diamond brand and they are just beginning to realize the full potential of our co-op brand.

Innovation is key to our success and sets us apart from other almond handlers. Our Almond Innovation Center is continually working on groundbreaking almond product ideas, experimenting with new categories for almond ingredient products and offering their expertise to our valued customers to spur research and development collaboration. These partnerships provide new avenues for Blue Diamond’s almonds, growing the market to the benefit of our grower-owners.

This winter, a strong El Niño is predicted. This is welcome news after a year where the natural and media climates seemed to have teamed together against the almond industry. However welcome the rain will be, we cannot return to our pre-drought state of comfort. We must remain vigilant in our water conservation efforts and we must continue to be an honest and reliable source of information for our state legislators, regulators and the media. Our carefully cultivated relationships with these audiences have turned the conversation from one of blame to one of teamwork – every Californian against the drought, not against one another.

Our recent history has been defined by drought driven reductions in almond yields, almond supply shortages and prices rising to new record high levels.

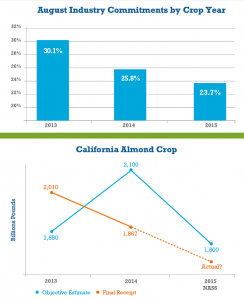

The 2015 crop will again be lower than last year or industry demand. In July, the National Agricultural Statistic Service (NASS) predicted a crop of 1.8 billion pounds. We expect the 2015 crop will deliver between 1.7 and 1.75 billion pounds, less than 94 percent of the 2014 supply. With the benefit of harvest data, the Nonpareil crop is likely 10 percent off of last year’s 713 million pounds.

Lower market commitments for the 2015 crop were consistent with recent pricing history. Many handlers were reluctant to offer early, recalling the multi-year trend of prices climbing throughout crop years. Last year, in particular, prices spiked dramatically during a disappointing harvest. The winning almond market strategy has been to sell later.

This year is different. Even with the 2015 crop falling short of the NASS Objective Estimate, market prices declined moderately. While California sellers offered sparingly, even more buyers were reluctant to make early 2015 crop purchases at prices equal to the peak prices paid for late 2014 crop. The market is finding a new pricing equilibrium at levels above similar timing to last year, but below the summer peak.

Market direction in the months ahead will be determined by almond supply, global demand and whether California’s winter snow and rain has a positive impact on the ongoing drought. Blue Diamond’s value-added business model will make sure that the cooperative’s available handle will be put to the highest and best use, ensuring another year of strong returns for our growers. Our emphasis on innovation will see us through this drought and will remain a winning strategy for Blue Diamond Growers for the foreseeable future.